Long or Short Nifty?

28 Sep 2020 ● 08:05 AM

The choice of using trendlines and trend channels is not a big one. A trend channel is simply made up of 2 trendlines that are parallel to each other. They can be drawn from the bottom up or top-down. From important highs and lows to measure and map an Elliott wave trend. So pay attention to them. It is also important to know where false break downs occur. On this chart, the Nifty underwent a deeper correction after 3 months. But a parallel channel, drawn to the highs of prices from April to August, gives us an important support level near 10800 that held its own last week. The corrections in May and in Sept themselves moved inside falling channels drawn in blue. In May the bottom occurred exactly at the lower end of the blue channel and that was easy. but this week we reached 11000 at the blue channel on Wednesday one day before expiration and then on the day of expiration fell below it. This is where judgement is called for. Is this a breakdown that marks the start of a larger decline or simply a false breakdown that should end the move. By Monday we are back above the blue line and it looks like a false break. But two days ago only the Elliott wave counts and some key sentiment indicators discussed in the Long-Short Strategy update would have indicated that this was a panic reaction. A multi-factor model is therefore the key to understanding markets better. Psychology has to be measured with the use of market indicators and not a gut feel of what everybody is thinking. Was everybody bullish on Thursday? That question cannot be answered by your 5 friends but the market as a whole. On expiration, nifty open interest declined to the lowest level measured in number of shares reflecting that the market had given up its longs in frustration.

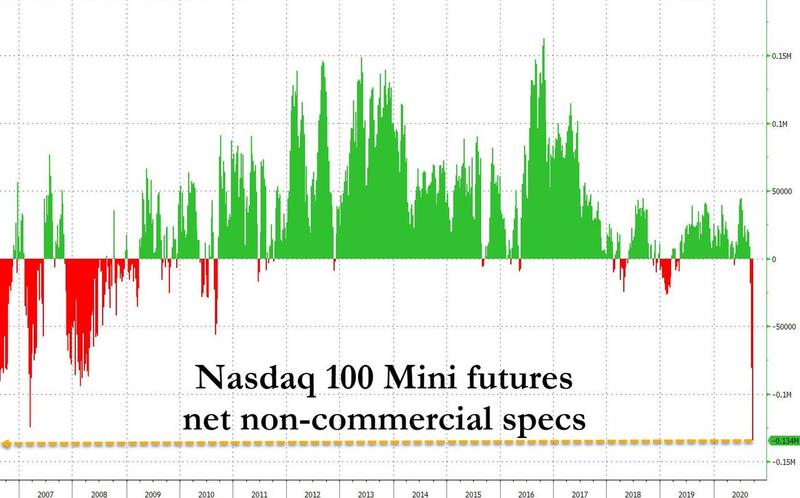

The longs capitulated. Now what we need to watch out for is if shorts will do the same, sell every rise on the way up. In some markets like the US Nasdaq, the CFTC futures Open Interest among traders shows the largest short position build up overnight, after a long time. This recent knee jerk reaction in stocks has resulted in an all out call to short this market. the size of the trade points to what usually follows....Short covering. This simply reflects the sentiment.

Comments (0)

Sort by

Latest First

Oldest First